Leave a Legacy

Leave a Legacy with the Blue Angels Foundation

Preserve the Legacy of the Blue Angels

With the 80th anniversary of the Blue Angels in 2026, we reflect on the enduring legacy of our nation’s heroes who have served with honor.

The Blue Angels Foundation is dedicated to supporting veterans as they transition from military service to civilian life. Your support, through planned giving, ensures that the legacy of the Blue Angels and the sacrifices of our nation’s heroes continue to be honored for generations to come.

Incorporating charitable giving strategies into your estate plan allows you to make a lasting impact on the lives of veterans while benefiting from significant tax advantages. By supporting the Blue Angels Foundation with a planned gift, you help provide essential services to veterans, addressing mental health, transitional housing, PTS resolution, and more.

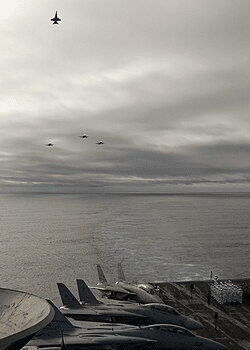

The Missing Man Formation

Just as the Blue Angels fly in tight formation to represent teamwork, excellence, and precision, the Missing Man Formation honors fallen heroes who have made the ultimate sacrifice.

By including the Blue Angels Foundation in your legacy plans, you’re paying tribute to those who have served, ensuring their sacrifice is never forgotten, and creating a brighter future for the veterans who are still with us today.

How you can help

Ways You Can Make a Difference

Testamentary Charitable Gifts

A testamentary charitable gift allows you to contribute to the Blue Angels Foundation through your will or trust. With no limits on the charitable estate tax deduction, you can leave a legacy that directly impacts veterans’ lives.

Charitable Remainders Trusts (CRT)

A CRT allows you to donate assets such as cash, stocks, or real estate, while receiving an income stream during your lifetime. After a designated period, the remaining trust assets are donated to the Blue Angels Foundation, providing essential services to veterans.

Charitable Lead Trusts (CLT)

A CLT enables you to donate to the Blue Angels Foundation for a fixed period while preserving the remainder for your heirs. The CLT offers income tax deductions during your lifetime and ensures a meaningful contribution to veterans’ programs.

Qualified Charitable Distributions (QCD)

If you’re 72 or older and required to take annual withdrawals from your retirement accounts, consider using your Required Minimum Distributions (RMDs) to make a QCD directly to the Blue Angels Foundation. This tax-friendly method helps reduce your taxable income while benefiting veterans.

Life Insurance

Consider naming the Blue Angels Foundation as a beneficiary of your life insurance policy. This is an effective way to amplify your charitable giving without affecting your assets today. Your contribution can have a significant impact on veterans’ support services.

Create Your Legacy,

Empower Veterans

Your planned gift helps us provide veterans with the mental health services, transitional housing, and PTS resolution programs they need to heal and thrive. By including the Blue Angels Foundation in your estate planning, you honor the legacy of the Blue Angels while making a lasting impact on the lives of veterans.

Ready to Make an Impact?

Speak with a tax professional or financial planner to explore the best planned giving strategy for your unique situation. Together, we can ensure that veterans continue to receive the care and support they deserve for years to come.

For more information about planned giving and how you can contribute to the Blue Angels Foundation, please contact Julie Headley, Executive Director.

Julie Headley

Executive Director, Blue Angels Foundation

[email protected]